I can’t believe it’s been almost a year since I was on my way to EWA’s National Seminar in Nashville to meet my new team and get a first glimpse at higher education media. Here I am again, not quite so green, at this year’s annual seminar in Chicago. The weather is a lot colder, but I’m still just as excited by education writing.

One of my favorite sessions this week was Can FAFSA Be Fixed? Big surprise, right? While I have a penchant for all things student financial aid, it’s not because I’m a financially-savvy numbers nut. College cost and student financial aid poses real and perceived barriers for many students, especially low-income, first-generation students, to access higher education—and I’m all about equity and equality in education.

So let’s look at some FAFSA stats for a second. It currently has 106 questions and is longer than 1040 tax forms. In 2014, 19.2 million families filed a FAFSA, and depending on the college, 33 to 100 percent of students will be required to verify information used when completing the form—which means extra forms and more than 106 questions for a huge number of students. The FAFSA offers a confusing, redundant, sometimes discriminatory experience and has poor timing. And it spits out a misleading piece of information—the Expected Family Contribution. Now, reading that, a rational person would understand that to be the amount of money that their family is required to pay for college attendance, which is not true. In fact, 76% of families pay more than their EFC, and that number jumps to 95% for low-income families.

No wonder it has a negative stigma and people refer to it as the dreaded, horrible, complicated FAFSA. One has to ask—why don’t they change it? And the short answer is that the form and process HAS actually evolved since its introduction. It’s just not quite done yet, and the panel offered some insights and perspectives on where the FAFSA needed to go next. Here were my biggest takeaways from the session:

1) Proposed FAFSA changes are not new. Michelle Asha Cooper, president of the Institute for Higher Education Policy, blew my mind a little bit with her historical FAFSA timeline. And she made a great point: the FAFSA needs to continue to change and evolve to stay current and meet the needs of the neediest students, so changes that happen in the next few years won’t be the final changes to the FAFSA—nor should they be.

Michelle also dropped the sad fact that affordability is the real barrier, and changing the FAFSA is in no way a total solution. Financial aid will never catch up with college costs as they continue to rise. And so we also need to consider what we can do to get to the core issue of affordability.

2) Even though the FAFSA has been simplified, it’s still confusing and does not offer a user-friendly experience. It isn’t streamlined visually, it isn’t always clear who needs to be entering what information, and language (I’m looking at you, EFC) can be misleading or misinterpreted. Eliminating the EFC as a family measure on the confirmation page or renaming it could go a long way in helping $0 EFC students understand that college will likely NOT be free for them.

When Alana Mbanza, a college and career coach for Dr. Martin Luther King, Jr. College Preparatory School in Chicago, spoke about working with students and families on the FAFSA, I had very vivid flashbacks to my own experiences with students and financial aid applications. It’s confusing and there is disconnect with language, even though it’s not overly complicated. Errors, even though they can be corrected, lead to delays, which can in turn lead to a less-than-complete aid package. Or worse, no aid package.

3) The FAFSA needs to use all of the technology and information it can get, and it needs to do it better. The government already has access to a lot of information, and Ed Pacchetti of the Department of Education suggests that using that information better will also help streamline the process, especially for low-income families.

Right now, the IRS Data Retrieval Tool (DRT), which pulls information directly from taxes, is great, but it’s inconsistent, which is frustrating. And it doesn’t pull as much information from taxes and tax schedules as it could, and schedules could go a long way in providing a clearer financial picture. Additionally, families enrolled in federal assistance programs wouldn’t have to keep proving their low-income status if the FAFSA could access this information from another database.

4) Timing of financial aid applications should better align with admissions applications. It really is so strange that students have to apply to colleges before they know how much it’ll cost them. Right now, FAFSA is open on January 1 of each year and looks at the previous tax year BEFORE any taxes are filed. So if a student files a FAFSA early, as they are encouraged to, they basically have to redo it once their family files taxes—really not efficient.

Panelist Jesse O’Connell, assistant director for federal relations at the National Association of Student Financial Aid Administrators (NASFAA) said that FAFSA should consider prior prior year (though perhaps a different term would be helpful) information so that EVERYONE would be able to access tax information from the start of the process. Additionally, it makes sense that the financial aid application deadlines should align with admission deadlines. FAFSA should be open in September when students and families are looking at schools to help them use cost as tool to help make financially responsible college decisions.

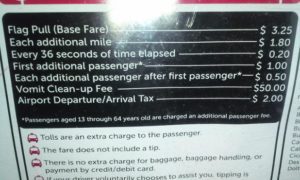

Hopefully some of the perceived barriers of the FAFSA will fade away if positive changes are made. Moderator Kim Clark, writer for Money, had a funny, gross, and sad way of demonstrating the need for changing financial aid applications: high school juniors in Chicago have better access and understanding of the financial implications of vomiting in a cab than they do with college financial aid. And that makes me want to vomit.

See All Posts